Ad Make your first steps on financial markets. If a futures trader is in a 30 income tax bracket and reports a 10000 profit on trades for the year 6000 of that profit would be taxed at 15 while only 4000 would be taxed at their regular tax rate.

Pdf Would A Financial Transaction Tax Affect Financial Market Activity Insights From Future Markets

Make a forecast and see the result in 1 minute.

Trading futures taxes. The best news for futures traders is US. Subtract the losses from your profits and that will give your capital gains. Per IRS trading rules commodities and futures transactions are classified as 1256 contracts.

This means that while 40 of your gains in futures trading is taxed at the same 35 rate as short-term stock trading 60 of your gains are taxed at. Capital gains and losses from futures trading are automatically split into 60 percent long term gains and 40 percent short term gains. Do you know what day trading taxes are.

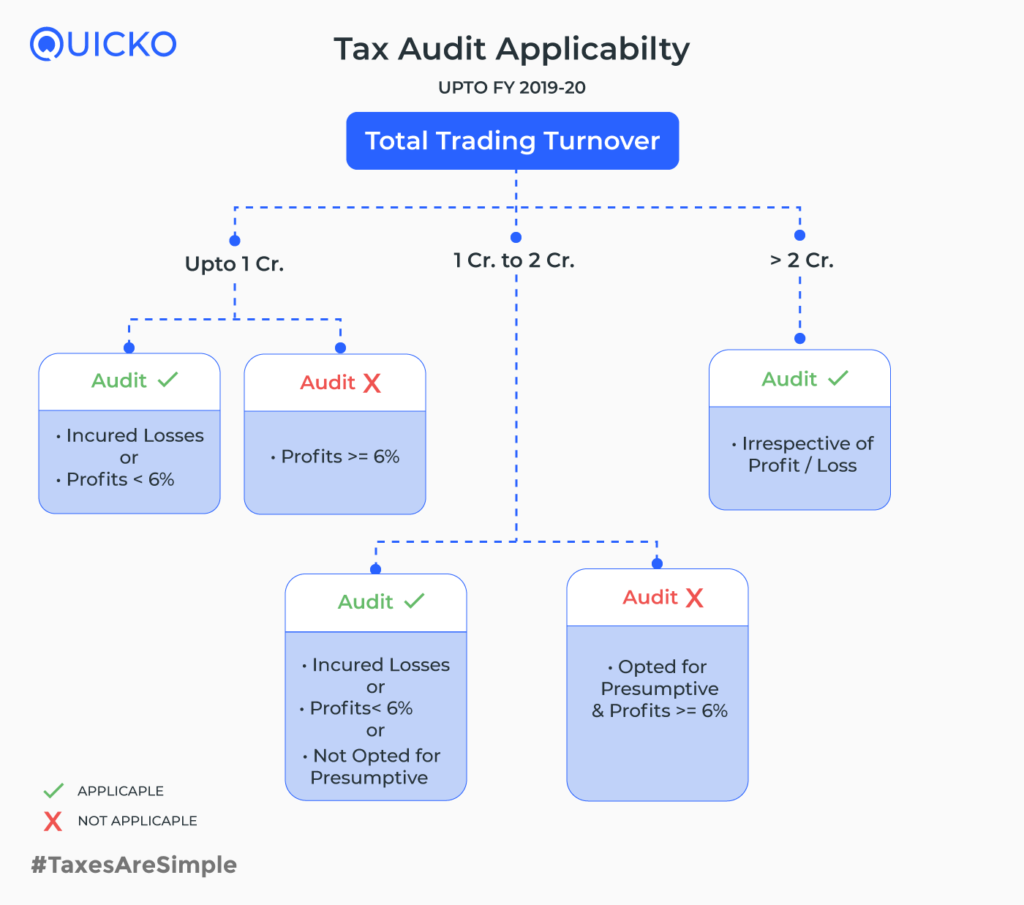

Benefits Under Section 435 Section 435 of the Income Tax Act states that any transactions that take place during Futures and Options trading are to be deemed non speculative transactions. Any taxable income that has been acquired from the trading of Futures and Options after any deductions have taken place is taxed as per prescribed income tax slab rates. With a sole proprietorship a trader eligible for trader tax status.

Long-term gains are capped at 15 and short-term gains are taxed at your ordinary tax rate which depends on your adjusted income. Enjoy 55 assets and free market strategies. Make a forecast and see the result in 1 minute.

Day traders are taxed close to 30 on their short term capital gains. More specifically futures contracts are taxed at 60 long-term capital gains and 40 at short-term capital gains. Trading income is not self-employment income SEI for triggering SE tax FICA and Medicare.

Futures traders enjoy a hybrid type of capital gains tax rate. Securities futures capital gainslosses are reported either on Schedule D Capital Gains and Losses or as ordinary capital gainslosses on IRS Form 4797 Part II Sales of Business Property if you elected mark-to-market accounting. Choosing capital gains and losses reporting with futures trading has a significant income tax rate advantage.

Heres a rundown how each is taxed or viewed by the IRS. Many traders with net profits from futures contracts minimize their taxes for the current year by closing losing non-futures positions before the end of the year. Trader Tax Status Designation You might qualify for Trader Tax Status TTS if you trade 30 hours or more out of a week and average more than.

There are favorable federal tax rates for commodities as they are taxed at 60 long-term capital gains and 40 short-term capital gains. If you actively trade securities futures forex or crypto consider setting up a trading business to maximize tax benefits. We make financial markets clear for everyone.

Your securities trades are taxed as short-term capital gains at the ordinary income tax rate of up to 35. Enjoy 55 assets and free market strategies. Ad Make your first steps on financial markets.

The capital losses thus realized. We make financial markets clear for everyone. How Do Forex Traders Get TaxedForex futures and options traders just like retail forex traders can tax their gains under the 6040 rule with 60 of gains taxed with a maximum rate of 15 it depends on how much income you make overall.

Futures contracts still are classified as Section 1256 contracts which. Long term capital gains are. This means that 60 of their income from futures trading will be taxed at 15 rather than their typical tax bracket rate.

While stocks are taxed at the 35 short-term capital gains rate for positions held less than a year futures are taxed 6040. Traders who are full members of a futures or options exchange are.

Indonesia Mulls Tax On Crypto Trading

Everything An F O Trader Should Know About Return Filing

Solutions For Smart Traders And Investors Who Want To Pay Less Taxes

Tax Efficient Investing In Gold

Income Tax Return Filing In Case Of Futures Options F O Trading

Day Trading Taxes How Profits On Trading Are Taxed

Tax On Intraday Trading Learn By Quickolearn By Quicko

Trading Futures Other Section 1256 Contracts Has Tax Advantages

Everything You Need To Know About Taxation For Investors Traders

Tax Advantages For Trading Futures Anthonycrudele Com

Tax Implications Of Trading In Securities

3 Tax Advantages Of Micro E Mini Futures Trading Ninjatrader Blog

Day Trading Don T Forget About Taxes Wealthfront

3 Tax Advantages Of Micro E Mini Futures Trading Ninjatrader Blog

3 Tax Advantages Of Micro E Mini Futures Trading Ninjatrader Blog

How Gains From Intraday Trading Are Taxed

Day Trading Taxes Explained Youtube

How To Structure A Trading Business For Significant Tax Savings